Common Payment Issues in Bangladesh

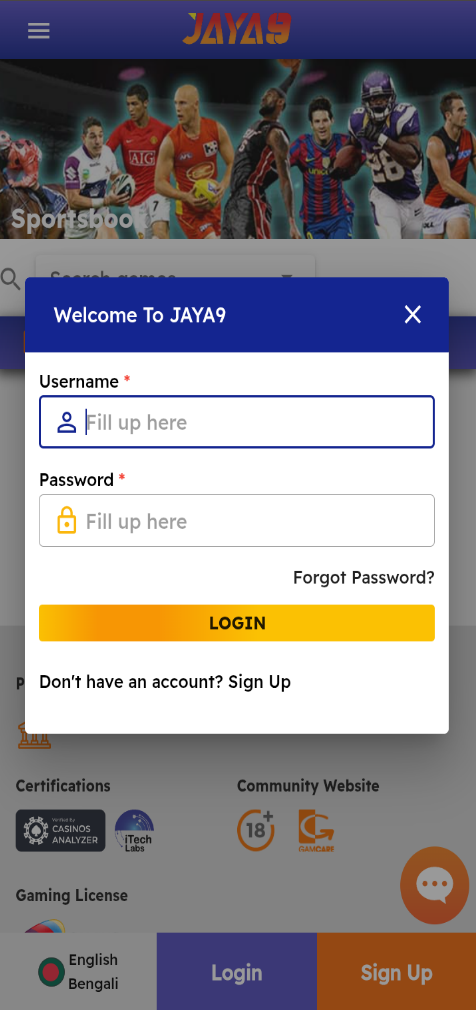

In the fast-evolving financial landscape of Bangladesh, Common Payment Issues in Bangladesh Casinos joya 9 stands as a key player in addressing the challenges associated with payments. However, despite strides in technology and access to financial services, various common payment issues persist, influencing both consumers and businesses. This article delves into these widespread payment challenges, examining their root causes and potential solutions.

1. Lack of Infrastructure

Despite significant advancements in digital payment systems, many rural and semi-urban areas in Bangladesh still lack the necessary infrastructure to support reliable payment transactions. Poor internet connectivity, limited access to banking facilities, and frequent power outages hinder the smooth operation of mobile and internet banking services.

2. Financial Literacy

A considerable portion of the Bangladeshi population remains unaware of modern payment methods and technologies. The gap in financial literacy leads to skepticism towards digital transactions, as many individuals prefer cash transactions due to a lack of understanding of electronic payment systems. Educational initiatives focusing on enhancing financial literacy could empower individuals to embrace digital payments confidently.

3. Trust and Security Issues

Security concerns are paramount in the realm of digital payments. Frequent news of cybercrimes and data breaches has created a wall of mistrust among consumers regarding the safety of online transactions. Many potential users hesitate to switch from cash to digital forms due to fears of fraud. Strengthening security measures and promoting transparency can help ameliorate these trust issues.

4. Transaction Failures

Transaction failures are another pressing issue faced by users of digital payment systems in Bangladesh. Failed transactions can lead to double payments, lost money, or delayed payments, frustrating consumers and merchants alike. Issues often stem from technical glitches, inadequate system integration, or server outages. Addressing these technical challenges requires ongoing investment and commitment from service providers.

5. Bank Processing Delays

Traditional banking processes may lag when dealing with digital transactions. Delays in fund transfers and processing can disrupt business operations and customer satisfaction. Enhanced interbank co-operation and streamlined processes are crucial to rectify these delays and improve the overall transaction speed.

6. High Costs of Transactions

While digital payments have the potential to reduce costs over time, many users in Bangladesh face high transaction fees. Charges associated with mobile wallet transactions, local bank transfers, and remittances can be prohibitively expensive, particularly for low-income individuals. Exploring zero-cost models or subsidized platforms could provide relief to the economically challenged segments of society.

7. Regulatory Challenges

The regulatory environment for digital payment systems in Bangladesh is still evolving, creating uncertainties for providers and users alike. Inconsistent policies or indecisiveness can lead to confusion and apprehension. Developing clear guidelines and regulations concerning mobile banking, e-commerce transactions, and overall payment systems will help create a safer and more trustworthy financial ecosystem.

8. Currency Exchange Issues

In an increasingly globalized economy, currency exchange issues are also a consideration in payment transactions. Fluctuating exchange rates can cause problems for businesses and consumers engaged in international trade or remittances. Improving currency stability and providing accessible exchange rate information can ease these concerns.

9. Accessibility for the Elderly and Disabled

As the world moves towards digital transactions, ensuring accessibility for the elderly and disabled in Bangladesh remains a challenge. Many traditional banking systems do not accommodate sensors or other aids for individuals with disabilities, complicating their ability to engage in financial transactions. Designing inclusive payment systems that cater to all demographics can enhance overall access for everyone.

Conclusion

In conclusion, while Bangladesh’s journey towards a robust digital payment system is commendable, common payment issues hinder progress. By addressing infrastructure gaps, enhancing financial literacy, and prioritizing security, the nation can create a more inclusive and efficient payment landscape. Stakeholders—governments, financial institutions, and technology providers—must work in unison to mitigate these challenges and unlock the potential of digital payments for all citizens.